A must-read book as it challenges conventional wisdom about money and provides valuable insights on financial independence and wealth creation. It offers practical advice and personal anecdotes that inspire readers to think differently about their financial future.

Learning Center

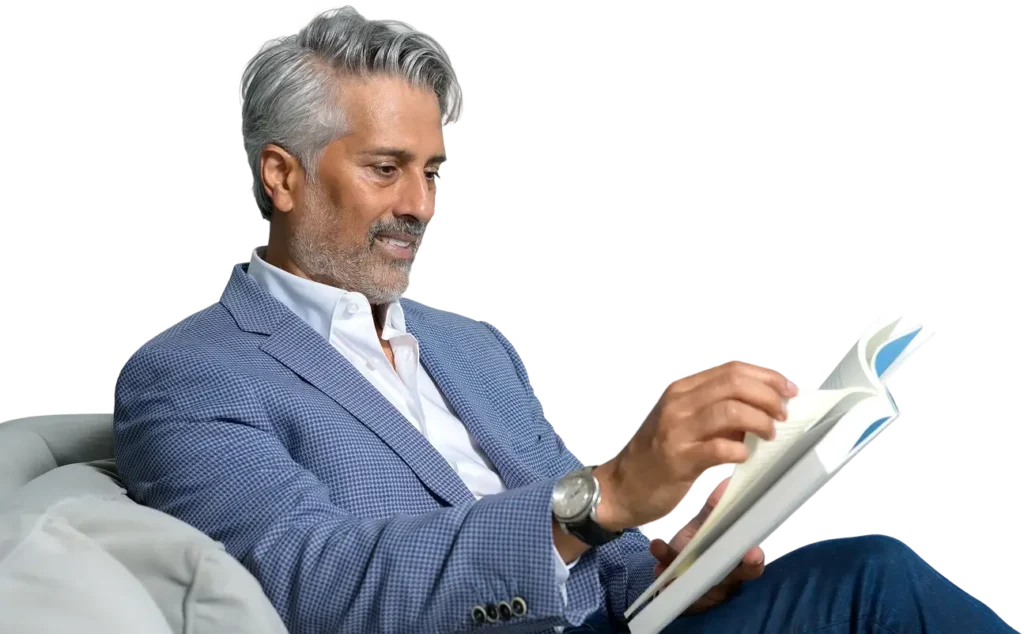

Real Estate Investing

REAL ESTATE INVESTING FOR BEGINNERS

Rental Apartments

Apartment investing doesn’t have to be complicated.

In my beginner course, I walk you through the different types of rental properties, from luxury Class A buildings to value-add fixer-uppers and show you how to start building long-term wealth, step by step.

Book a Free Private Consultation with Robert

Personalized Investment Guidance Awaits

I can help you create alternate passive income from real estate that will eventually replace your W-2 income. This will allow you to maintain your lifestyle well into retirement.

ARTICLES

Real Estate Education

Healthcare is a calling; but it is also demanding. Long shifts, emotional intensity, and years...

For many professionals, especially those with demanding careers, wealth is often built through high income...

As a healthcare professional, you’re used to navigating complex terminology. From clinical abbreviations to diagnostic...

Book Recommendations

Knowledge is Power

Rich Dad Poor Dad

By Robert Kiyosaki

Atomic Habits

By James Clear

This book is a must-read for anyone looking to improve their personal or professional lives as it offers a fresh perspective on how small, incremental changes can lead to remarkable results over time. Clear’s empha…

10x is easier than 2x

By Dan Sullivan

Offers a powerful mindset shift that challenges conventional thinking and encourages exponential growth. This book provides practical strategies and insights to help individuals unlock their potential.

The Miracle Morning

By Hal Elrod

Provides a powerful framework for starting each day with purpose and productivity, helping readers create a positive and successful mindset. It offers actionable strategies to cultivate habits that can transform their lives and unlock personal growth and fulfillment.

Real Estate Terms

industry LANGUAGE

Active with Contract

Also known as “active under contract,” this status means a property has an offer with contingencies that haven’t been met yet.

Active Contingent

A property with an offer submitted by a buyer, but the sale won’t be finalized until specific conditions (contingencies) are met.

Accrued Interest

Interest that grows and is added to a loan or investment.

Absorptions

The net change in the total number of apartment homes leased.

Accredited Investor

According to the US Securities and Exchange Commission (SEC), an accredited investor is an individual or entity that meets certain financial criteria and is deemed to have sufficient financial sophistication and ability to bear the risks associated with certain types of investments. The SEC’s definition includes several categories of accredited investors, such as:

1.Individuals:

- Those with an annual income exceeding 200,000(300,000 for joint income) in the two most recent years, with the expectation of reaching a similar income level in the current year.

- Those with a net worth exceeding $1 million, either individually or jointly with a spouse, excluding the value of their primary residence.

- Entities:

- Certain corporations, partnerships, and organizations with total assets exceeding $5 million.

- Certain trusts with assets in excess of $5 million, not formed for the specific purpose of acquiring the securities offered.

Frequently Asked Questions

Real Estate Investing

What is the best way to start investing in multifamily real estate?

Beginning your investment journey in multifamily real estate starts with education. Familiarize yourself with the market, understand financing options, and consider partnering with experienced investors or advisors. It’s also prudent to start with a clear investment goal and a solid financial plan.